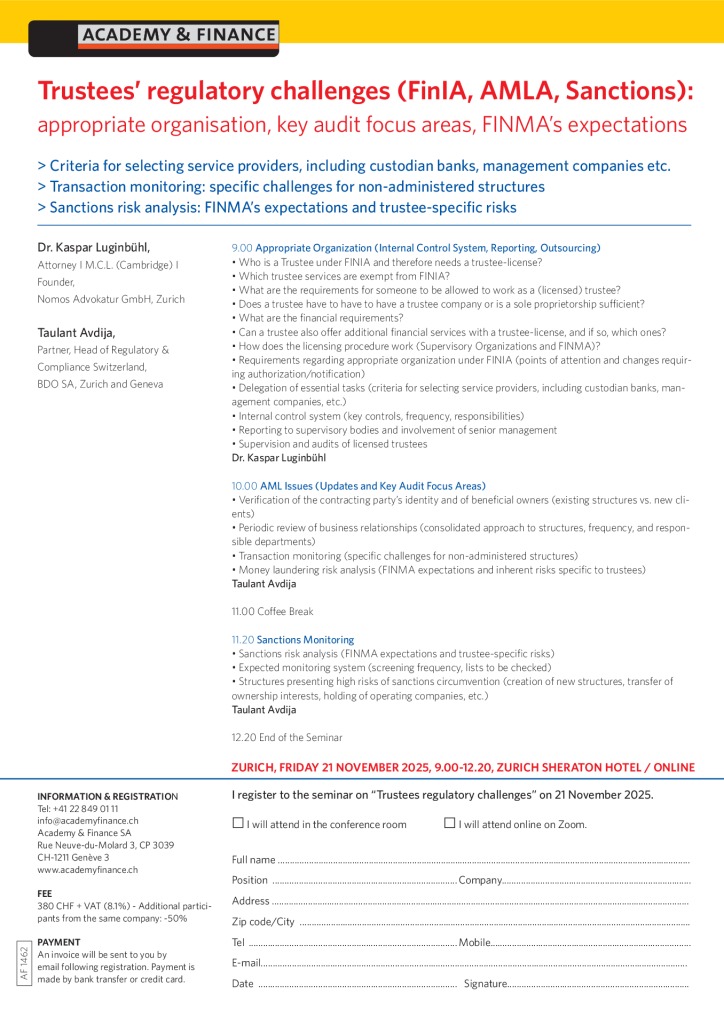

Criteria for selecting service providers, including custodian banks, management companies etc.

Transaction monitoring: specific challenges for non-administered structures

Sanctions risk analysis: FINMA expectations and trustee-specific risks

Appropriate Organization (Internal Control System, Reporting, Outsourcing)

- Who is a Trustee under FINIA and therefore needs a trustee-license?

- Which trustee services are exempt from FINIA?

- What are the requirements for someone to be allowed to work as a (licensed) trustee?

- Does a trustee have to have to have a trustee company or is a sole proprietorship sufficient?

- What are the financial requirements?

- Can a trustee also offer additional financial services with a trustee-license, and if so, which ones?

- How does the licensing procedure work (Supervisory Organizations and FINMA)?

- Requirements regarding appropriate organization under FINIA (points of attention and changes requiring authorization/notification)

- Delegation of essential tasks (criteria for selecting service providers, including custodian banks, management companies, etc.)

- Internal control system (key controls, frequency, responsibilities)

- Reporting to supervisory bodies and involvement of senior management

- Supervision and audits of licensed trustees

AML Issues (Updates and Key Audit Focus Areas)

- Verification of the contracting party’s identity and of beneficial owners (existing structures vs. new clients)

- Periodic review of business relationships (consolidated approach to structures, frequency, and responsible departments)

- Transaction monitoring (specific challenges for non-administered structures)

- Money laundering risk analysis (FINMA expectations and inherent risks specific to trustees)

Sanctions Monitoring

- Sanctions risk analysis (FINMA expectations and trustee-specific risks)

- Expected monitoring system (screening frequency, lists to be checked)

- Structures presenting high risks of sanctions circumvention (creation of new structures, transfer of ownership interests, holding of operating companies, etc.)

SPEAKERS

Dr. Kaspar Luginbühl, Attorney I M.C.L. (Cambridge) I Founder, Nomos Advokatur GmbH, Zurich

Taulant Avdija, Partner, Head of Regulatory & Compliance Switzerland, BDO SA, Zurich and Geneva

Trustees’ regulatory challenges (FinIA, AMLA, Sanctions): appropriate organisation, key audit focus areas, FINMA’s expectations

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch