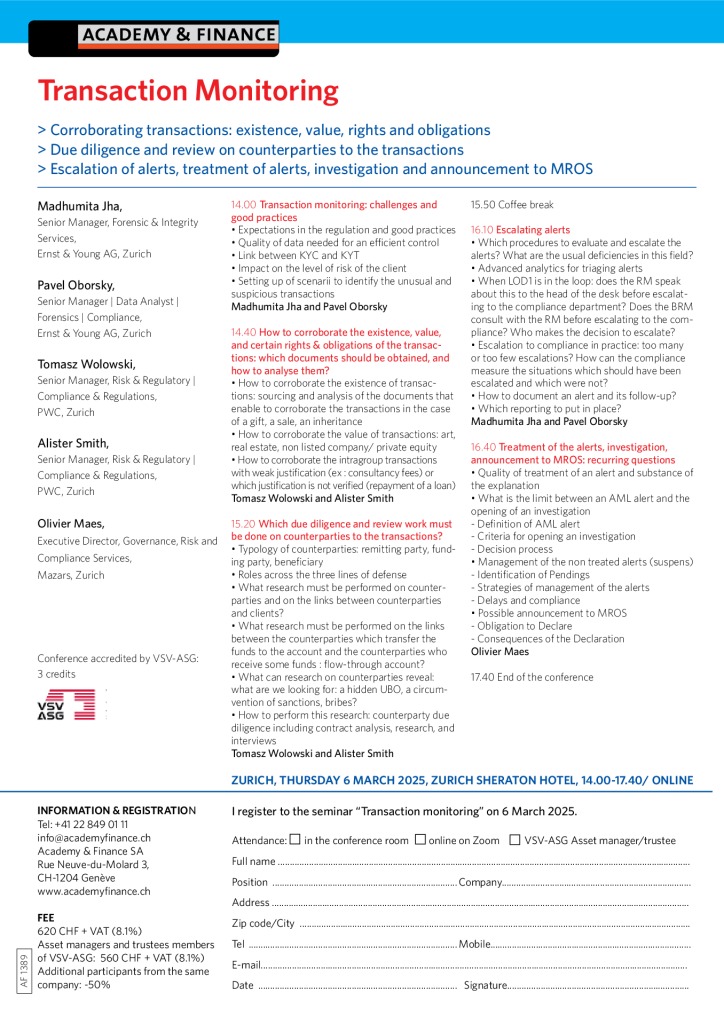

Setting up scenarii, corroboration, counterparties, escalation, treatment of alerts

Transaction monitoring : challenges and good practices

- Expectations in the regulation and good practices

- Quality of data needed for an efficient control

- Link between KYC and KYT

- Impact on the level of risk of the client

- Setting up of scenarii to identify the unusual and suspicious transactions

How to corroborate the reality and the value of the transactions: which documents should be obtained, and how to analyse them?

- How to corroborate the existence of the transactions: exploitation and critical analysis of the documents that enable to corroborate the transactions in the case of a gift, a sale, an inheritance

- How to corroborate the value of the transactions: art, real estate, non listed company/ private equity

- How to corroborate the intragroup transactions with weak justification (ex : consultancy fees) or which justification is not verified (repayment of a loan)

Which due diligence work must be done on counterparties to the transactions?

- Typology of counterparties: remitting party, funding party, beneficiary

- What research must be performed on counterparties and on the links between counterparties and clients?

- What research must be performed on the links between the counterparties which transfer the funds to the account and the counterparties who receive some funds : flow-through account?

- What can the research on counterparties reveal : what are we looking for: a hidden UBO, a circumvention of sanctions, bribes?

- How to perform this research : ex: analysis of contracts, what does it tell? How to read the contracts?

Escalating alerts

- Which procedures to evaluate and escalate the alerts? What are the usual deficiencies in this field?

- Advanced analytics for triaging alerts

- When LOD1 is in the loop: does the RM speak about this to the head of the desk before escalating to the compliance department? Does the BRM consult with the RM before escalating to the compliance? Who makes the decision to escalate?

- Escalation to compliance in practice: too many or too few escalations? How can the compliance measure the situations which should have been escalated and which were not?

- How to document an alert and its follow-up?

- Which reporting to put in place?

Treatment of the alerts, investigation, announcement to MROS: recurring questions

- Quality of treatment of an alert and substance of the explanation

- What is the limit between an AML alert and the opening of an investigation

- Definition of AML alert

- Criteria for opening an investigation

- Decision process

- Management of the non treated alerts (suspens)

- Identification of Pendings

- Strategies of management of the alerts

- Delays and compliance

- Possible announcement to MROS

- Obligation to Declare

- Consequences of the Declaration

SPEAKERS

Madhumita Jha, Senior Manager, Forensic & Integrity Services, Ernst & Young AG, Zurich

Pavel Oborsky, Senior Manager | Data Analyst | Forensics | Compliance, Ernst & Young AG, Zurich

Tomasz Wolowski, Senior Manager, Risk & Regulatory | Compliance & Regulations, PWC, Zurich

Alister Smith, Senior Manager, Risk & Regulatory | Compliance & Regulations, PWC, Zurich

Olivier Maes, Executive Director, Risk and Compliance Services, Mazars, Zurich

Transaction Monitoring

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch