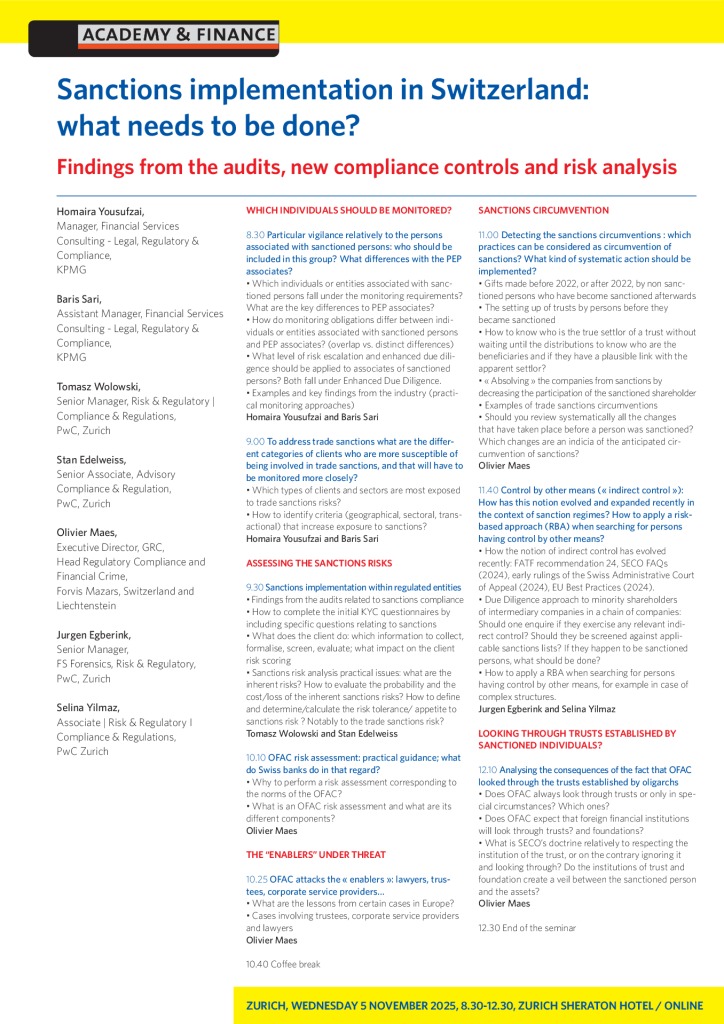

Findings from the audits, new compliance controls and risk analysis

WHICH INDIVIDUALS SHOULD BE MONITORED?

Particular vigilance relatively to the persons associated with sanctioned persons: who should be included in this group? What differences with the PEP associates?

- Which individuals or entities associated with sanctioned persons fall under the monitoring requirements? What are the key differences to PEP associates?

- How do monitoring obligations differ between individuals or entities associated with sanctioned persons and PEP associates? (overlap vs. distinct differences)

- What level of risk escalation and enhanced due diligence should be applied to associates of sanctioned persons? Both fall under Enhanced Due Diligence.

- Examples and key findings from the industry (practical monitoring approaches)

To address trade sanctions what are the different categories of clients who are more susceptible of being involved in trade sanctions, and that will have to be monitored more closely?

- Which types of clients and sectors are most exposed to trade sanctions risks?

- How to identify criteria (geographical, sectoral, transactional) that increase exposure to sanctions?

ASSESSING THE SANCTIONS RISKS

Sanctions implementation within regulated entities

- Findings from the audits related to sanctions compliance

- How to complete the initial KYC questionnaires by including specific questions relating to sanctions

- What does the client do: which information to collect, formalise, screen, evaluate; what impact on the client risk scoring

- Sanctions risk analysis practical issues: what are the inherent risks? How to evaluate the probability and the cost/loss of the inherent sanctions risks? How to define and determine/calculate the risk tolerance/ appetite to sanctions risk ? Notably to the trade sanctions risk?

OFAC risk assessment: practical guidance; what do Swiss banks do in that regard?

- Why to perform a risk assessment corresponding to the norms of the OFAC?

- What is an OFAC risk assessment and what are its different components?

THE “ENABLERS” UNDER THREAT

OFAC attacks the « enablers »: lawyers, trustees, corporate service providers…

- What are the lessons from certain cases in Europe?

- Cases involving trustees, corporate service providers and lawyers

SANCTIONS CIRCUMVENTION

Detecting the sanctions circumventions : which practices can be considered as circumvention of sanctions? What kind of systematic action should be implemented?

- Gifts made before 2022, or after 2022, by non sanctioned persons who have become sanctioned afterwards

- The setting up of trusts by persons before they became sanctioned

- How to know who is the true settlor of a trust without waiting until the distributions to know who are the beneficiaries and if they have a plausible link with the apparent settlor?

- « Absolving » the companies from sanctions by decreasing the participation of the sanctioned shareholder

- Examples of trade sanctions circumventions

- Should you review systematically all the changes that have taken place before a person was sanctioned? Which changes are an indicia of the anticipated circumvention of sanctions?

Control by other means (« indirect control »): How has this notion evolved and expanded recently in the context of sanction regimes? How to apply a risk-based approach (RBA) when searching for persons having control by other means?

- How the notion of indirect control has evolved recently: FATF recommendation 24, SECO FAQs (2024), early rulings of the Swiss Administrative Court of Appeal (2024), EU Best Practices (2024).

- Due Diligence approach to minority shareholders of intermediary companies in a chain of companies: Should one enquire if they exercise any relevant indirect control? Should they be screened against applicable sanctions lists? If they happen to be sanctioned persons, what should be done?

- How to apply a RBA when searching for persons having control by other means, for example in case of complex structures.

LOOKING THROUGH TRUSTS ESTABLISHED BY SANCTIONED INDIVIDUALS?

Analysing the consequences of the fact that OFAC looked through the trusts established by oligarchs

- Does OFAC always look through trusts or only in special circumstances? Which ones?

- Does OFAC expect that foreign financial institutions will look through trusts? and foundations?

- What is SECO’s doctrine relatively to respecting the institution of the trust, or on the contrary ignoring it and looking through? Do the institutions of trust and foundation create a veil between the sanctioned person and the assets?

SPEAKERS

Homaira Yousufzai, Manager, Financial Services Consulting – Legal, Regulatory & Compliance, KPMG

Baris Sari, Assistant Manager, Financial Services Consulting – Legal, Regulatory & Compliance, KPMG

Tomasz Wolowski, Senior Manager, Risk & Regulatory | Compliance & Regulations, PwC, Zurich

Stan Edelweiss, Senior Associate, Advisory Compliance & Regulation, PwC, Zurich

Olivier Maes, Executive Director, GRC, Head Regulatory Compliance and Financial Crime, Forvis Mazars, Switzerland and Liechtenstein

Jurgen Egberink, Senior Manager, FS Forensics, Risk & Regulatory, PwC, Zurich

Selina Yilmaz, Associate | Risk & Regulatory I Compliance & Regulations, PwC Zurich

Sanctions implementation in Switzerland: what needs to be done?

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch