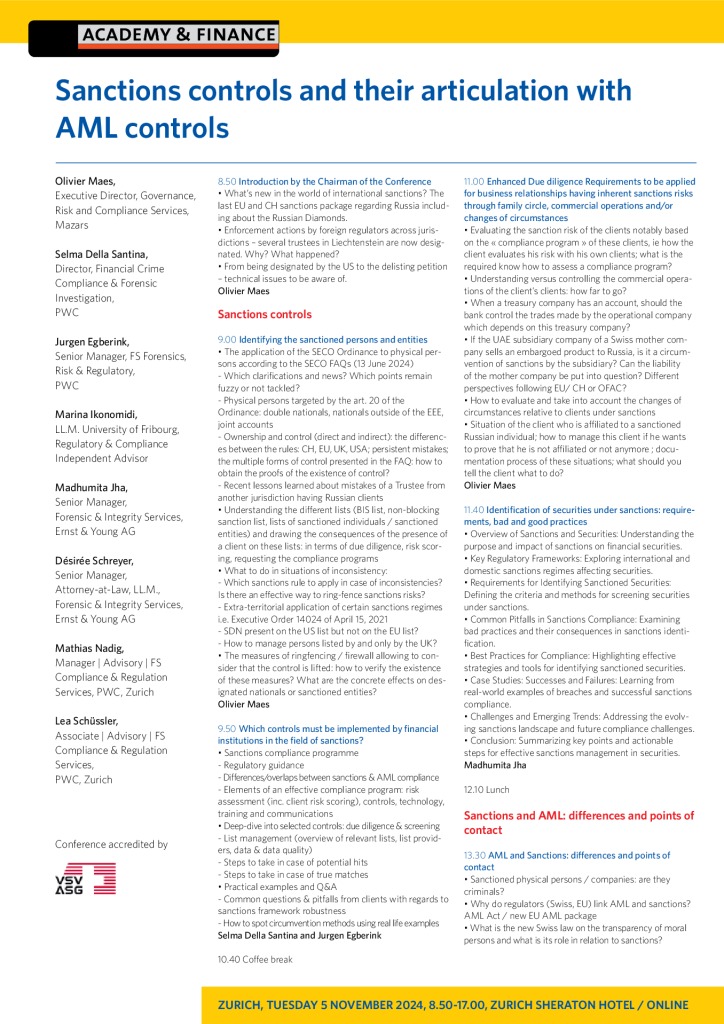

Introduction by the Chairman of the Conference

- What’s new in the world of international sanctions? The last EU and CH sanctions package regarding Russia including about the Russian Diamonds.

- Enforcement actions by foreign regulators across jurisdictions – several trustees in Liechtenstein are now designated. Why? What happened?

- From being designated by the US to the delisting petition – technical issues to be aware of.

Sanctions controls

Identifying the sanctioned persons and entities

- The application of the SECO Ordinance to physical persons according to the SECO FAQs (13 June 2024)

- Which clarifications and news? Which points remain fuzzy or not tackled?

- Physical persons targeted by the art. 20 of the Ordinance: double nationals, nationals outside of the EEE, joint accounts

- Ownership and control (direct and indirect): the differences between the rules: CH, EU, UK, USA; persistent mistakes; the multiple forms of control presented in the FAQ: how to

obtain the proofs of the existence of control? - Recent lessons learned about mistakes of a Trustee from another jurisdiction having Russian clients

- Understanding the different lists (BIS list, non-blocking sanction list, lists of sanctioned individuals / sanctioned entities) and drawing the consequences of the presence of a client on these lists: in terms of due diligence, risk scoring, requesting the compliance programs

- What to do in situations of inconsistency:

- Which sanctions rule to apply in case of inconsistencies? Is there an effective way to ring-fence sanctions risks?

- Extra-territorial application of certain sanctions regimes i.e. Executive Order 14024 of April 15, 2021

- SDN present on the US list but not on the EU list?

- How to manage persons listed by and only by the UK?

- The measures of ringfencing / firewall allowing to consider that the control is lifted: how to verify the existence of these measures? What are the concrete effects on designated nationals or sanctioned entities?

Which controls must be implemented by financial institutions in the field of sanctions?

- Sanctions compliance programme

- Regulatory guidance

- Differences/overlaps between sanctions & AML compliance

- Elements of an effective compliance program: risk assessment (inc. client risk scoring), controls, technology, training and communications

- Deep-dive into selected controls: due diligence & screening

- List management (overview of relevant lists, list providers, data & data quality)

- Steps to take in case of potential hits

- Steps to take in case of true matches

- Practical examples and Q&A

- Common questions & pitfalls from clients with regards to sanctions framework robustness

- How to spot circumvention methods using real life examples

Enhanced Due diligence Requirements to be applied for business relationships having inherent sanctions risks through family circle, commercial operations and/or changes of circumstances

- Evaluating the sanction risk of the clients notably based on the « compliance program » of these clients, ie how the client evaluates his risk with his own clients; what is the required know how to assess a compliance program?

- Understanding versus controlling the commercial operations of the client’s clients: how far to go?

- When a treasury company has an account, should the bank control the trades made by the operational company which depends on this treasury company?

- If the UAE subsidiary company of a Swiss mother company sells an embargoed product to Russia, is it a circumvention of sanctions by the subsidiary? Can the liability of the mother company be put into question? Different perspectives following EU/ CH or OFAC?

- How to evaluate and take into account the changes ofcircumstances relative to clients under sanctions

- Situation of the client who is affiliated to a sanctioned Russian individual; how to manage this client if he wants to prove that he is not affiliated or not anymore ; documentation process of these situations; what should you tell the client what to do?

Identification of securities under sanctions: requirements, bad and good practices

- Overview of Sanctions and Securities: Understanding the purpose and impact of sanctions on financial securities.

- Key Regulatory Frameworks: Exploring international and domestic sanctions regimes affecting securities.

- Requirements for Identifying Sanctioned Securities: Defining the criteria and methods for screening securities under sanctions.

- Common Pitfalls in Sanctions Compliance: Examining bad practices and their consequences in sanctions identification.

- Best Practices for Compliance: Highlighting effective strategies and tools for identifying sanctioned securities.

- Case Studies: Successes and Failures: Learning from real-world examples of breaches and successful sanctions compliance.

- Challenges and Emerging Trends: Addressing the evolving sanctions landscape and future compliance challenges.

- Conclusion: Summarizing key points and actionable steps for effective sanctions management in securities.

Sanctions and AML: differences and points of contact

AML and Sanctions: differences and points de contact

- Sanctioned physical persons / companies: are they criminals?

- Why do regulators (Swiss, EU) link AML and sanctions? AML Act / new EU AML package

- What is the new Swiss law on the transparency of moral persons and what is its role in relation to sanctions?

- In the AMLA draft what is the restriction relative to the violation by negligence of the announcement duty? Is it connected to the future law on transparency and the activity of the compliance officer?

- Which coercion measures are included in the law on embargos?

- Violation of sanctions / circumvention of sanctions : when are they a predicate offense to money laundering?

- Which crimes related to sanctions can be qualified as money laundering or as predicate offense to money laundering? Example : the sale of weapons to Russia can be a violation and a circumvention of sanctions

- Apart from clients, who else (service providers and financial institutions) can be put into question for a predicate offense to ML or for money laundering?

Performing sanctions controls and AML controls together, not in silos

How to perform sanctions controls and AML controls consistently and in a coordinated manner (not in silos)?

- Widening the KYC to cover the sanctions aspects and need for Integrated Compliance: Why coordinate sanctions and AML controls.

- Detecting the restructurings of the ownership of entities that constitute a circumvention of sanctions

- Managing the AML aspects and the sanctions aspects together at onboarding: what are the common red flags? Which sanctions red flags can alert on the AML risks and inversely?

- If the client is sanctioned, or a parent of a sanctioned individual, or is on the BIS list, or has been involved in a circumvention: what are the consequences

- Joint Risk Assessments: Conducting combined risk evaluations.

- Unified Compliance Framework: Aligning sanctions and AML processes.

- Integrated Technology: Using tools for both sanctions and AML checks.

- Transaction monitoring : AML and sanctions

The sanctions compliance audit required by FINMA

The main points of attention of the additional audit « Sanctions compliance » requested by FINMA ; component of the prudential audit

- Sanctions risk analysis, with notably a determination of risk tolerance vis-à-vis countries under sanction ; similarities with AML risk analysis ; what possible inconsistencies to be avoided between AML risk analysis and sanctions risk analysis?

- Directives and organisation: an adequate control system Organisational measures relative to the asset declaration to SECO and to immediate freezing: what are the requested steps between the moment of the alert that someone is on a list and the declaration to SECO

- Documentation of decisions to report / not to report

- Controls of ownership and control on a physical person, a company, an organisation under sanctions are performed correctly

- Organisation of screening: what must be the frequency of screening? How often must the lists of persons under sanctions be updated?

A concrete problem: delisting clients

Rights of the defense versus listing and delisting in light of smart or targeted sanctions

- What could a petitioner seeking to submit a request for a sanction delisting do? What is the impact if done alone or with the support of a law firm?

- Rights of defense versus listing on sanctions lists without trial and/or hearing.

- Delisting procedures in Switzerland – Interaction with the Federal Department of Economic Affairs, Education and Research (EAER) for independent Swiss sanctions

- Delisting procedures for UN sanctions (the Focal Point

for Delisting) - Delisting petition and procedures with OFAC (US)

SPEAKERS

Olivier Maes, Executive Director, Governance, Risk and Compliance Services, Mazars

Selma Della Santina, Director, Financial Crime Compliance & Forensic Investigation, PWC

Jurgen Egberink, Senior Manager, FS Forensics, Risk & Regulatory, PWC

Marina Ikonomidi, LL.M. University of Fribourg, Regulatory & Compliance Independent Advisor

Madhumita Jha, Senior Manager, Forensic & Integrity Services, Ernst & Young AG

Désirée Schreyer, Senior Manager, Attorney-at-Law, LL.M., Forensic & Integrity Services, Ernst & Young AG

Mathias Nadig, Manager | Advisory | FS Compliance & Regulation Services, PWC, Zurich

Lea Schüssler, Associate | Advisory | FS Compliance & Regulation Services, PWC, Zurich

Sanctions controls and their articulation with AML controls

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch