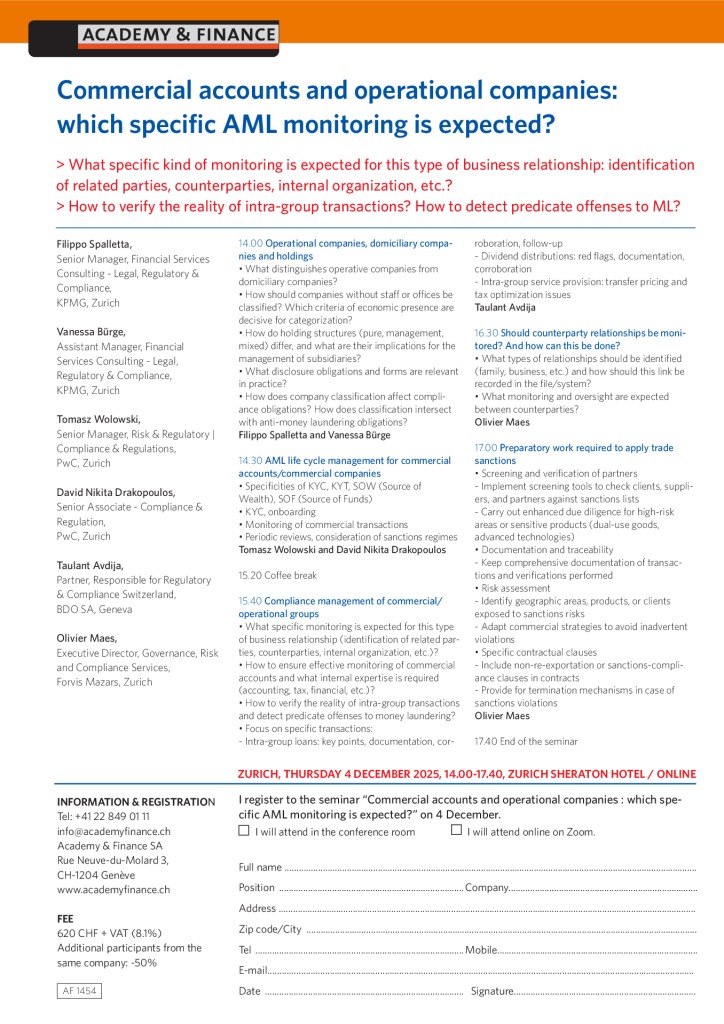

What specific kind of monitoring is expected for this type of business relationship: identification of related parties, counterparties, internal organization, etc.?

How to verify the reality of intra-group transactions? How to detect predicate offenses to ML?Operational companies, domiciliary companies and holdings

- What distinguishes operative companies from domiciliary companies?

- How should companies without staff or offices be classified? Which criteria of economic presence are decisive for categorization?

- How do holding structures (pure, management, mixed) differ, and what are their implications for the management of subsidiaries?

- What disclosure obligations and forms are relevant in practice?

- How does company classification affect compliance obligations? How does classification intersect with anti-money laundering obligations?

AML life cycle management for commercial accounts/commercial companies

- Specificities of KYC, KYT, SOW (Source of Wealth), SOF (Source of Funds)

- KYC, onboarding

- Monitoring of commercial transactions

- Periodic reviews, consideration of sanctions regimes

Compliance management of commercial/operational groups

- What specific monitoring is expected for this type of business relationship (identification of related parties, counterparties, internal organization, etc.)?

- How to ensure effective monitoring of commercial accounts and what internal expertise is required (accounting, tax, financial, etc.)?

- How to verify the reality of intra-group transactions and detect predicate offenses to money laundering?

- Focus on specific transactions:

- Intra-group loans: key points, documentation, corroboration, follow-up

- Dividend distributions: red flags, documentation, corroboration

- Intra-group service provision: transfer pricing and tax optimization issues

Should counterparty relationships be monitored? And how can this be done?

- What types of relationships should be identified (family, business, etc.) and how should this link be recorded in the file/system?

- What monitoring and oversight are expected between counterparties?

Preparatory work required to apply trade sanctions

- Screening and verification of partners

- Implement screening tools to check clients, suppliers, and partners against sanctions lists

- Carry out enhanced due diligence for high-risk areas or sensitive products (dual-use goods, advanced technologies)

- Documentation and traceability

- Keep comprehensive documentation of transactions and verifications performed

- Risk assessment

- Identify geographic areas, products, or clients exposed to sanctions risks

- Adapt commercial strategies to avoid inadvertent violations

- Specific contractual clauses

- Include non-re-exportation or sanctions-compliance clauses in contracts

- Provide for termination mechanisms in case of sanctions violations

SPEAKERS

Filippo Spalletta, Senior Manager, Financial Services Consulting – Legal, Regulatory & Compliance, KPMG, Zurich

Vanessa Bürge, Assistant Manager, Financial Services Consulting – Legal, Regulatory & Compliance, KPMG, Zurich

Tomasz Wolowski, Senior Manager, Risk & Regulatory | Compliance & Regulations, PwC, Zurich

David Nikita Drakopoulos, Senior Associate – Compliance & Regulation, PwC, Zurich

Taulant Avdija, Partner, Responsible for Regulatory & Compliance Switzerland, BDO SA, Geneva

Olivier Maes, Executive Director, Governance, Risk and Compliance Services, Forvis Mazars, Zurich

Commercial accounts and operational companies: which specific AML monitoring is expected?

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch