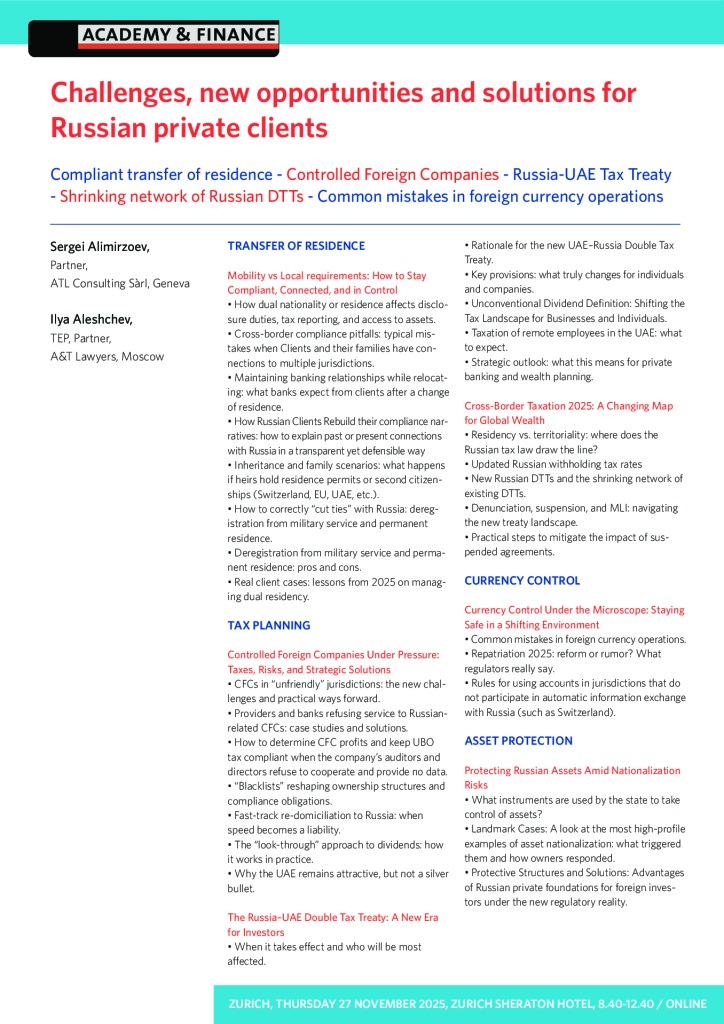

Compliant transfer of residence – Controlled Foreign Companies – Russia-UAE Tax Treaty – Shrinking network of Russian DTTs – Common mistakes in foreign currency operations

TRANSFER OF RESIDENCE

Mobility vs Local requirements: How to Stay Compliant, Connected, and in Control

- How dual nationality or residence affects disclosure duties, tax reporting, and access to assets.

- Cross-border compliance pitfalls: typical mistakes when Clients and their families have connections to multiple jurisdictions.

- Maintaining banking relationships while relocating: what banks expect from clients after a change of residence.

- How Russian Clients Rebuild their compliance narratives: how to explain past or present connections with Russia in a transparent yet defensible way

- Inheritance and family scenarios: what happens if heirs hold residence permits or second citizenships (Switzerland, EU, UAE, etc.).

- How to correctly “cut ties” with Russia: deregistration from military service and permanent residence.

- Deregistration from military service and permanent residence: pros and cons.

- Real client cases: lessons from 2025 on managing dual residency.

TAX PLANNING

Controlled Foreign Companies Under Pressure: Taxes, Risks, and Strategic Solutions

- CFCs in “unfriendly” jurisdictions: the new challenges and practical ways forward.

- Providers and banks refusing service to Russian-related CFCs: case studies and solutions.

- How to determine CFC profits and keep UBO tax compliant when the company’s auditors and directors refuse to cooperate and provide no data.

- “Blacklists” reshaping ownership structures and compliance obligations.

- Fast-track re-domiciliation to Russia: when speed becomes a liability.

- The “look-through” approach to dividends: how it works in practice.

- Why the UAE remains attractive, but not a silver bullet.

The Russia–UAE Double Tax Treaty: A New Era for Investors

- When it takes effect and who will be most affected.

- Rationale for the new UAE–Russia Double Tax Treaty.

- Key provisions: what truly changes for individuals and companies.

- Unconventional Dividend Definition: Shifting the Tax Landscape for Businesses and Individuals.

- Taxation of remote employees in the UAE: what to expect.

- Strategic outlook: what this means for private banking and wealth planning.

Cross-Border Taxation 2025: A Changing Map for Global Wealth

- Residency vs. territoriality: where does the Russian tax law draw the line?

- Updated Russian withholding tax rates

- New Russian DTTs and the shrinking network of existing DTTs.

- Denunciation, suspension, and MLI: navigating the new treaty landscape.

- Practical steps to mitigate the impact of suspended agreements.

CURRENCY CONTROL

Currency Control Under the Microscope: Staying Safe in a Shifting Environment

- Common mistakes in foreign currency operations.

- Repatriation 2025: reform or rumor? What regulators really say.

- Rules for using accounts in jurisdictions that do not participate in automatic information exchange with Russia (such as Switzerland).

ASSET PROTECTION

Protecting Russian Assets Amid Nationalization Risks

- What instruments are used by the state to take control of assets?

- Landmark Cases: A look at the most high-profile examples of asset nationalization: what triggered them and how owners responded.

- Protective Structures and Solutions: Advantages of Russian private foundations for foreign investors under the new regulatory reality.

SPEAKERS

Sergei Alimirzoev, Partner, ATL Consulting Sàrl, Geneva

Ilya Aleshchev, TEP, Partner, A&T Lawyers, Moscow

Challenges, new opportunities and solutions for Russian private clients

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch