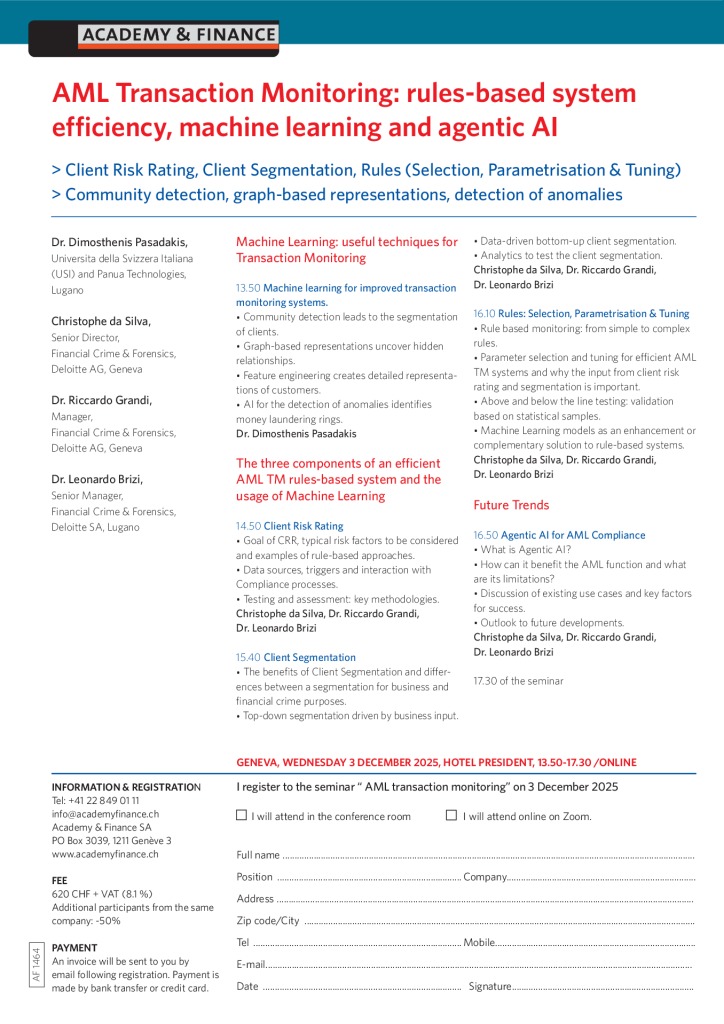

> Client Risk Rating, Client Segmentation, Rules (Selection, Parametrisation & Tuning)

> Community detection, graph-based representations, detection of anomalies

Machine Learning: useful techniques for Transaction Monitoring

Machine learning for improved transaction monitoring systems.

- Community detection leads to the segmentation of clients.

- Graph-based representations uncover hidden relationships.

- Feature engineering creates detailed representations of customers.

- AI for the detection of anomalies identifies money laundering rings.

The three components of an efficient AML TM rules-based system and the usage of Machine Learning

Client Risk Rating

- Goal of CRR, typical risk factors to be considered and examples of rule-based approaches.

- Data sources, triggers and interaction with Compliance processes.

- Testing and assessment: key methodologies.

Client Segmentation

- The benefits of Client Segmentation and differences between a segmentation for business and financial crime purposes.

- Top-down segmentation driven by business input.

- Data-driven bottom-up client segmentation.

- Analytics to test the client segmentation.

Rules: Selection, Parametrisation & Tuning

- Rule based monitoring: from simple to complex rules.

- Parameter selection and tuning for efficient AML TM systems and why the input from client risk rating and segmentation is important.

- Above and below the line testing: validation based on statistical samples.

- Machine Learning models as an enhancement or complementary solution to rule-based systems.

Future Trends

Agentic AI for AML Compliance

- What is Agentic AI?

- How can it benefit the AML function and what are its limitations?

- Discussion of existing use cases and key factors for success.

- Outlook to future developments.

SPEAKERS

Dr. Dimosthenis Pasadakis, Universita della Svizzera Italiana (USI) and Panua Technologies, Lugano

Christophe da Silva, Senior Director, Financial Crime & Forensics, Deloitte AG, Geneva

Dr. Riccardo Grandi, Manager, Financial Crime & Forensics, Deloitte AG, Geneva

Dr. Leonardo Brizi, Senior Manager, Financial Crime & Forensics, Deloitte SA, Lugano

AML Transaction Monitoring: rules-based system efficiency, machine learning and agentic AI

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch