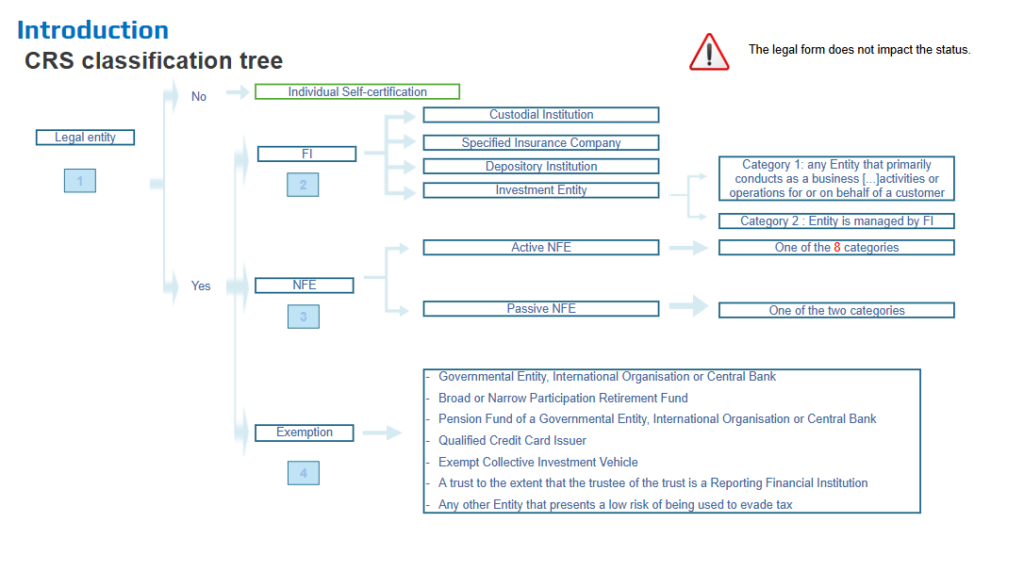

> Learn how to navigate through the different steps of the classification trees

> Know how to classify the different holdings: investment entity, active NFE, passive NFE

> Practical examples of classification relevant to the Swiss market

Methodology for Entity Classification according to CRS and FATCA

- What is a financial institution in Switzerland (banks, asset managers, trustees, etc.)?

- What is an Investment Entity?

- What is an active non-financial entity (NFE) and a passive NFE?

- Main differences between FATCA and CRS

- Classification tree for FATCA

- Classification tree for CRS

Classification of Holding Companies

- Investment Entities :

– What are the qualification criteria for a holding company to be classified as an Investment Entity

– Examples of holding companies that are considered as investment entities. - Active NFEs:

– What are the conditions for a holding company to be considered as an active NFE?

– Frequent cases - Passive NFEs:

– Which critera define a holding company as a passive NFE?

– Consequences of this classification, notably regarding the identification of the controlling persons - Analysis of assets and incomes:

– Why is it crucial to analyse the assets (financial / non financial) held by the holding?

– How does the classification of the entities held or the passive and active incomes influence the classification?

Classification of Trusts in Switzerland

- FATCA/CRS treatment of trusts

- Swiss specificities: role of trustees and links with private banks

- Identification of parties: settlor, trustee, beneficiaries, protector

- Reporting obligations and grey areas

- Common cases in practice

Impact of Classification

- Reporting obligations depending on classification

- Identification of controlling persons (UBOs)

- Tax and regulatory implications for Swiss financial institutions

Case Studies

- Practical examples of classification in the Swiss market

- Challenges for practitioners (private banks, family trusts, management companies)

SPEAKERS

Latifa Tabia, Operational Tax and Structuring Expert, Luxembourg

Latifa advises international clients on complex tax matters, with strong expertise in FATCA, CRS, DAC6, QI, FASTER, and Pillar 2.

She is the former Head of Operational Tax & Advisory at Forvis Mazars, and previously worked at Société Générale and Natixis Wealth Management, where she led operational tax teams and managed Operational tax guidance for entities in Luxembourg, Switzerland, and Monaco.

Latifa holds degrees in Wealth Legal and Tax Engineering from Université Panthéon-Assas and Université Panthéon-Sorbonne, and the Luxembourg tax qualification (Cycle A and Cycle B).

Areas of expertise:

• Operational taxation

• Regulatory compliance

• International tax obligations

CRS/FATCA classification of holdings and trusts

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch