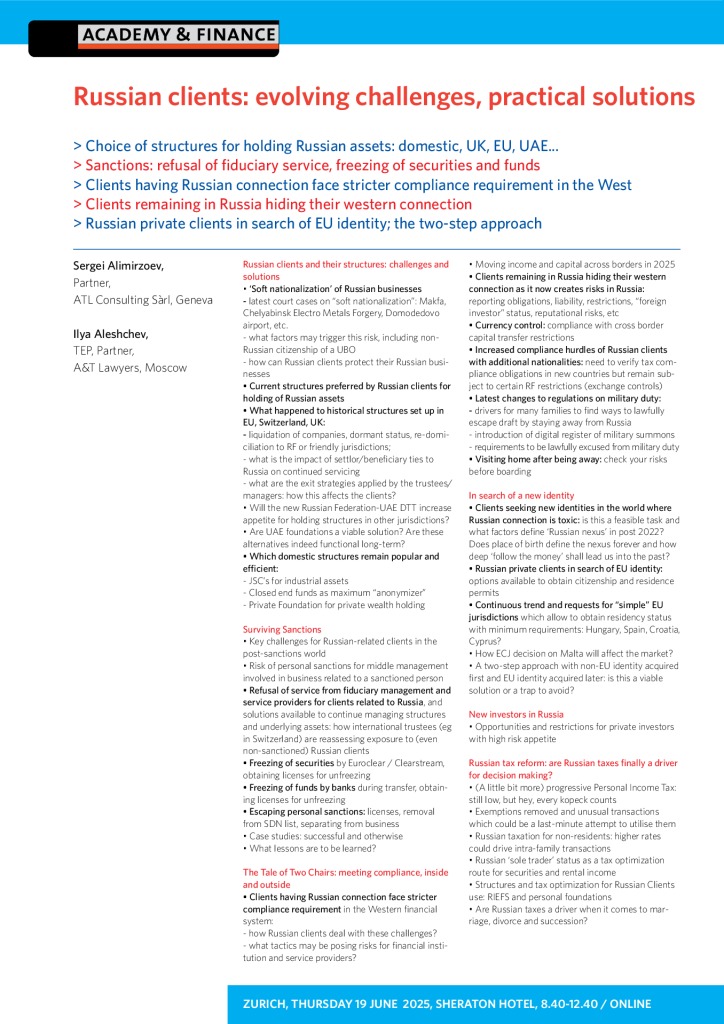

> Choice of structures for holding Russian assets: domestic, UK, EU, UAE…

> Sanctions: refusal of fiduciary service, freezing of securities and funds

> Clients having Russian connection face stricter compliance requirement in the West

> Clients remaining in Russia hiding their western connection

> Russian private clients in search of EU identity; the two-step approach

Russian clients and their structures: challenges and solutions

- ‘Soft nationalization’ of Russian businesses

- latest court cases on “soft nationalization”: Makfa, Chelyabinsk Electro Metals Forgery, Domodedovo airport, etc.

- what factors may trigger this risk, including non-Russian citizenship of a UBO

- how can Russian clients protect their Russian businesses

- Current structures preferred by Russian clients for holding of Russian assets

- What happened to historical structures set up in EU, Switzerland, UK:

- liquidation of companies, dormant status, re-domiciliation to RF or friendly jurisdictions;

- what is the impact of settlor/beneficiary ties to Russia on continued servicing

- what are the exit strategies applied by the trustees/managers: how this affects the clients?

- Will the new Russian Federation-UAE DTT increase appetite for holding structures in other jurisdictions?

- Are UAE foundations a viable solution? Are these alternatives indeed functional long-term?

- Which domestic structures remain popular and efficient:

- JSC’s for industrial assets

- Closed end funds as maximum “anonymizer”

- Private Foundation for private wealth holding

Surviving Sanctions

- Key challenges for Russian-related clients in the post-sanctions world

- Risk of personal sanctions for middle management involved in business related to a sanctioned person

- Refusal of service from fiduciary management and service providers for clients related to Russia, and solutions available to continue managing structures and underlying assets: how international trustees (eg in Switzerland) are reassessing exposure to (even non-sanctioned) Russian clients

- Freezing of securities by Euroclear / Clearstream, obtaining licenses for unfreezing

- Freezing of funds by banks during transfer, obtaining licenses for unfreezing

- Escaping personal sanctions: licenses, removal from SDN list, separating from business

- Case studies: successful and otherwise

- What lessons are to be learned?

The Tale of Two Chairs: meeting compliance, inside and outside

- Clients having Russian connection face stricter compliance requirement in the Western financial system:

- how Russian clients deal with these challenges?

- what tactics may be posing risks for financial institution and service providers?

- Moving income and capital across borders in 2025

- Clients remaining in Russia hiding their western connection as it now creates risks in Russia:

reporting obligations, liability, restrictions, “foreign investor” status, reputational risks, etc - Currency control: compliance with cross border capital transfer restrictions

- Increased compliance hurdles of Russian clients with additional nationalities: need to verify tax compliance obligations in new countries but remain subject to certain RF restrictions (exchange controls)

- Latest changes to regulations on military duty:

- drivers for many families to find ways to lawfully escape draft by staying away from Russia

- introduction of digital register of military summons

- requirements to be lawfully excused from military duty

- Visiting home after being away: check your risks before boarding

In search of a new identity

- Clients seeking new identities in the world where Russian connection is toxic: is this a feasible task and what factors define ‘Russian nexus’ in post 2022? Does place of birth define the nexus forever and how deep ‘follow the money’ shall lead us into the past?

- Russian private clients in search of EU identity: options available to obtain citizenship and residence permits

- Continuous trend and requests for “simple” EU jurisdictions which allow to obtain residency status with minimum requirements: Hungary, Spain, Croatia, Cyprus?

- How ECJ decision on Malta will affect the market?

- A two-step approach with non-EU identity acquired first and EU identity acquired later: is this a viable solution or a trap to avoid?

New investors in Russia

- Opportunities and restrictions for private investors with high risk appetite

Russian tax reform: are Russian taxes finally a driver for decision making?

- (A little bit more) progressive Personal Income Tax: still low, but hey, every kopeck counts

- Exemptions removed and unusual transactions which could be a last-minute attempt to utilise them

- Russian taxation for non-residents: higher rates could drive intra-family transactions

- Russian ‘sole trader’ status as a tax optimization route for securities and rental income

- Structures and tax optimization for Russian Clients use: RIEFS and personal foundations

- Are Russian taxes a driver when it comes to marriage, divorce and succession?

SPEAKERS

Sergei Alimirzoev, Partner, ATL Consulting Sàrl, Geneva

Ilya Aleshchev, TEP, Partner, A&T Lawyers, Moscow

Russian clients: evolving challenges, practical solutions

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch