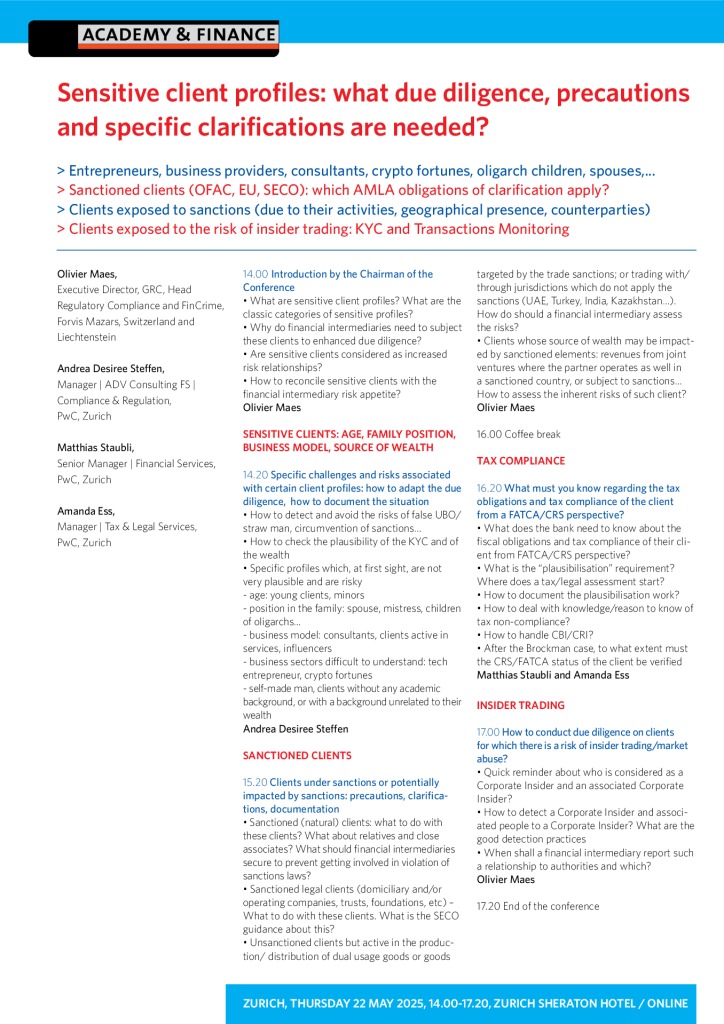

> Entrepreneurs, business providers, consultants, crypto fortunes, oligarch children, spouses,…

> Sanctioned clients (OFAC, EU, SECO): which AMLA obligations of clarification apply?

> Clients exposed to sanctions (due to their activities, geographical presence, counterparties)

> Clients exposed to the risk of insider trading: KYC and Transactions Monitoring

INTRODUCTION

Introduction by the Chairman of the Conference

- Definition of «contract management»

- Reminder of contractual freedom

- Legal and regulatory requirements

- Wide variety of contracts in the financial sector

- Focus on certain contracts: outsourcing contracts, IT contracts

- Impact of new technologies in the contractual field: artificial intelligence (AI)

SENSITIVE CLIENTS: AGE, FAMILY POSITION, BUSINESS MODEL, SOURCE OF WEALTH

Specific challenges and risks associated with certain client profiles: how to adapt the due diligence, how to document the situation

- How to detect and avoid the risks of false UBO/straw man, circumvention of sanctions…

- How to check the plausibility of the KYC and of the wealth

- Specific profiles which, at first sight, are not very plausible and are risky

- age: young clients, minors

- position in the family: spouse, mistress, children of oligarchs…

- business model: consultants, clients active in services, influencers

- business sectors difficult to understand: tech entrepreneur, crypto fortunes

- self-made man, clients without any academic background, or with a background unrelated to their wealth

SANCTIONED CLIENTS

Clients under sanctions or potentially impacted by sanctions: precautions, clarifications, documentation

- Sanctioned (natural) clients: what to do with these clients? What about relatives and close associates? What should financial intermediaries secure to prevent getting involved in violation of sanctions laws?

- Sanctioned legal clients (domiciliary and/or operating companies, trusts, foundations, etc) – What to do with these clients. What is the SECO guidance about this?

- Unsanctioned clients but active in the production/ distribution of dual usage goods or goods targeted by the trade sanctions; or trading with/through jurisdictions which do not apply the sanctions (UAE, Turkey, India, Kazakhstan…). How do should a financial intermediary assess the risks?

- Clients whose source of wealth may be impacted by sanctioned elements: revenues from joint ventures where the partner operates as well in a sanctioned country, or subject to sanctions… How to assess the inherent risks of such client?

TAX COMPLIANCE

What must you know regarding the tax obligations and tax compliance of the client from a FATCA/CRS perspective?

- What does the bank need to know about the fiscal obligations and tax compliance of their client from FATCA/CRS perspective?

- What is the “plausibilisation” requirement? Where does a tax/legal assessment start?

- How to document the plausibilisation work?

- How to deal with knowledge/reason to know of tax non-compliance?

- How to handle CBI/CRI?

- After the Brockman case, to what extent must the CRS/FATCA status of the client be verified

INSIDER TRADING

How to conduct due diligence on clients for which there is a risk of insider trading/market abuse?

- Quick reminder about who is considered as a Corporate Insider and an associated Corporate Insider?

- How to detect a Corporate Insider and associated people to a Corporate Insider? What are the good detection practices

- When shall a financial intermediary report such a relationship to authorities and which?

SPEAKERS

Olivier Maes, Executive Director, GRC, Head Regulatory Compliance and FinCrime, Forvis Mazars, Switzerland and Liechtenstein

Anna Metodieva, Manager, Financial Crime, PwC, Zurich

Matthias Staubli, Senior Manager, Financial Services, PwC, Zurich

Amanda Ess, Manager, Tax & Legal Services, PwC, Zurich

Sensitive client profiles: what due diligence, precautions and specific clarifications are needed?

I wish to see this past conference on zoom

Contact by the phone

ACADEMY & FINANCE SA

Rue Neuve-du-Molard 3

1204 Genève

Switzerland

T + 41 (0)22 849 01 11

E info@academyfinance.ch